For deaths in 2022 the exemption is 1206 million. Accountings and Releases.

Foreign Executor Bonds Estate Bonds Fca Insurance

The most likely recipients are your spouse your children your parents or your siblings.

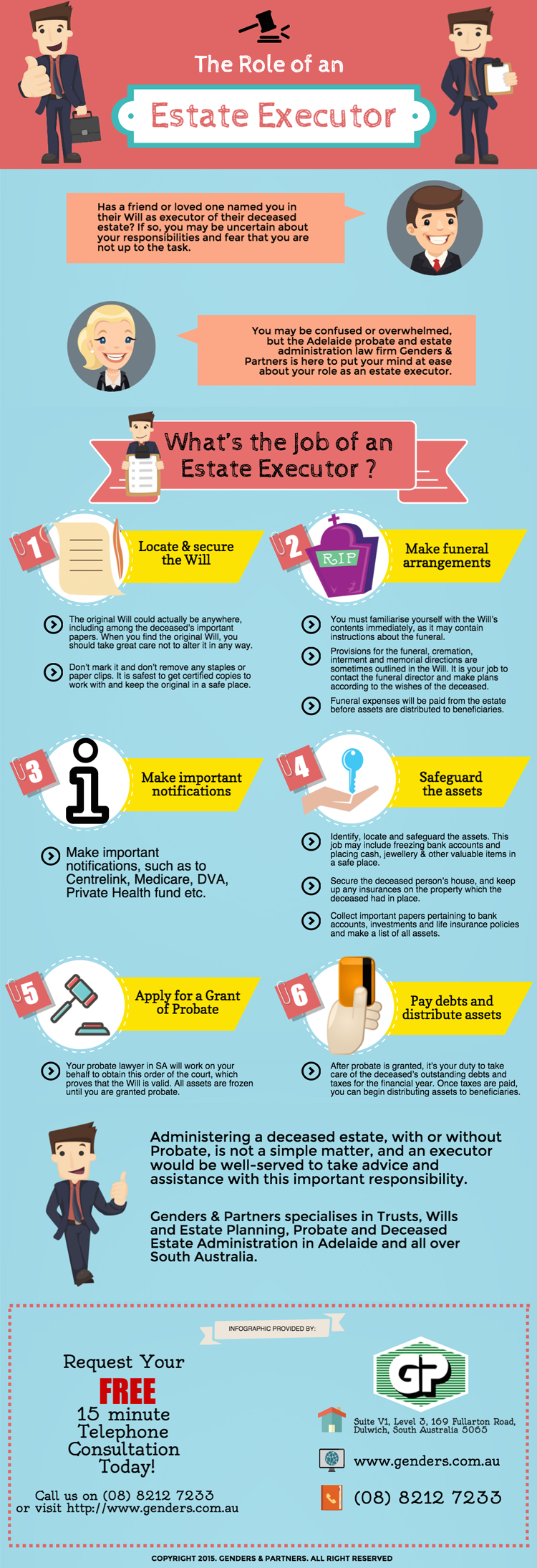

. Probate Committeeship Services. If there is no will or the executors named in a will do not wish to act an administrator of the deceaseds estate may instead be appointed. For every decision you make as an executor you should be able to explain how that is the best choice for the interests of the estate.

As a result there is no tangible testimony to follow and hence there can be no executor. Dying without a will. Executor or Administrator Duties.

A Living Will or an Advance Directive. The judge will grant the executor authorization to act on behalf of the estate through letters testamentary or letters of administration Executors provide these documents to entities such as insurance companies or financial institutions to confirm that they have the legal authority to act on behalf of the estate. The Aboriginal Affairs and Northern Development Canada AANDC Estates programs are part of AANDCs responsibilities under the Indian Act to help families manage the legal and financial affairs also known as estates of deceased minor or mentally incompetent Status Indians as defined in the Indian Act.

The generic term for. File annual property and income tax returns. See Sample Checklist Create Your Own.

This requirement is intended to curb executors conducting the affairs of the estate in their own self-interest. Superannuation and life insurance payments may or may not form part of the deceased estate. Pay off debts pay estate taxes plan asset distributions etc.

A probate lawyer from Westcoast Wills Estates can ease the burden on executors and estate administrators. This is true even if the proceeds are paid under an accident or. The fiduciary also must value financial assets including bank and securities accounts.

Dying without a will. There is no way by which a majority can make a decision when it comes to executor appointments. Life insurance proceeds paid to a beneficiary because of the death of the insured or because the insured is a member of the US.

It is similar to an individual tax return that a person files every calendar year but not all estates and trusts are required to file it. This process is called intestate succession or intestacy Who gets what depends on who your closest relatives are. National Disability Insurance Scheme NDIS Powers of attorney.

If there are stipulated beneficiaries under the policies the payments may go directly to the beneficiaries without going through the deceased estate. A Nomination of Committee. Apply for a grant of probate they must be over 18 when they apply distribute the estate according to the Will.

That said recall that one executor is not entitled to assume unilateral control over the estate to the exclusion of co-executors and an executor who does so should not expect to receive all the compensation. As a beneficiary its natural to wonder how long it will take before the process ends and you receive any inheritance coming. Form 1041 is an income tax return for estates and trusts.

Public Guardian and Trustee. Creditors Debts and Expenses. Estates must file Form 1041 if they earn over 600 in income or have a beneficiary that is a nonresident alien.

Challenging an unfair will. The stresses of being an executor of a will can often be overwhelming. Appropriate insurance should be maintained throughout the fiduciarys tenure.

Estates Not Exceeding 25000. This therefore means that challenging an executor can be done by both co-executors and beneficiaries to an estate. The cost of the lawyer comes out of the estate.

A fiduciary is someone in a position of trust and authority to manage property for the benefit of another. This exemption amount rises each year to adjust for inflation Only estates larger than the exemption amount may owe federal estate taxso you dont need to worry about making a life insurance trust unless you think that your life insurance policy will bring the size of your estate. The sharing of the aggregate fee among executors should be fair and absent agreement between executors a Court can impose it.

Notify insurance companies open estate account begin probate etc. Uniformed services who is missing in action arent taxable unless the policy was turned over to the recipient for a price. 2000000 in 2006 - 2008.

Executors administrators personal representatives and trustees are all titles of fiduciaries. When most people think of executing a will they might think only of delivering inherited assets to beneficiaries. If you have been appointed as an executor or administrator of the estate you will be responsible for.

Take or defend legal action on behalf of the estate. Some tasks can be performed by anyone such as notifying. This might lessen the appraisal costs that must be incurred.

In other words there are no taxes that a person who inherits from an estate must pay. Bear in mind that for federal estate tax returns for estates that do not owe any federal estate tax certain estimates are permitted. Estates Not Exceeding 15000.

This means executors must to act in the best interest of the estate at all times. If you die without making a will a court will distribute your property according to the laws of your state. No inheritance taxes in Ontario There are no true inheritance taxes in Ontario.

However very few estates will owe estate taxes. However there are actually several steps of the probate process that the executor must complete before transferring any assets. Executors must act together.

If someone dies without a will it can be hard to work out who should apply for permission to deal with the deceaseds estate. Assets Outside of Saskatchewan. Beneficiaries do not pay tax on the money they inherit from an estate.

Executors often need to hire a lawyer to assist them with some of this. Make distributions finalize probate close estate account etc. The law sets out how their.

Beneficiary Declarations including trusts for RRSPs Insurance policies TFSAs Pension Plans etc. Where there is more than one executor and the way forward cannot be agreed directions can be sought from the. Administrators are the fiduciaries appointed by the court when a person dies without a.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return. Executors are the fiduciaries appointed under a will and given authority by the court. A filing is required for estates with combined gross assets and prior taxable gifts exceeding 1500000 in 2004 - 2005.

Planning Your Wills And Estates In Germany Expatica

Which Form Does An Estate Executor Need To File H R Block

The Untold Challenges Of Being An Estate Executor

Executors Or Brokers Who Deals With Your Policies After You Die Aed Attorneys

5 Things You Must Know As The Executor Of An Estate Breyer Home Buyers

Executor Of Estate The Complete Guide Ramseysolutions Com

Will Photo Of A Last Will And Testament With Color And Blur Effect Aff Testament Photo Color Effect Estate Planning Probate Life Insurance Policy

What You Should Do Immediately After Your Appointment As Executor Of An Estate Estate Planning Funeral Costs Estates

Executor Checklist For Personal Representative Of Estate Checklist Estate Planning Estates

How To Clean Out A Deceased Estate Of A Loved One Deceased Estates House Cleaning Tips

The Role Of An Estate Executor Wills And Estate Planning

5 Tips For Credit Maintenance Before And During The Mortgage Process House Prices Rental Apartments Estates

Checklist For Use By Executor Checklist Printable Checklist Printable Chart

Estate Executor S Guide Part 1 Getting Started Qld Estate Lawyers

7 Tips For The Executor Of An Estate Bankrate Com Probate Writing Services Estate Planning

A Real Estate Agent Holding Keys To A New Apartment In Her Hands Real Estate In Aff Agent Holding Real Estat Estates House Prices Real Estate Agent

You Are Executor Of An Estate Now What Thestreet

I Am The Executor Of A Loved One S Estate Do I Need A Grant Of Probate Harrison Clark Rickerbys

What Is The Difference Between The Administrator Of An Estate And An Executor Of An Estate

ConversionConversion EmoticonEmoticon Off Topic